Media statements

NZ Superannuation Fund now worth close to $70 billion

POSTED ON: 8 February 2024

Share:

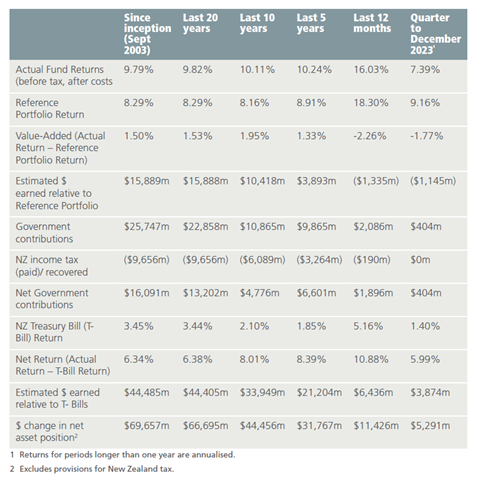

The New Zealand Superannuation Fund continued to increase in value during the second half of 2023, ending the calendar year with total assets of $69.66 billion.

The Fund generated a pre-tax return for the year of 16.03 percent, well ahead of the important Treasury Bill benchmark for the same period, which came in at 5.16 percent.

Paula Steed, Acting CEO of Super Fund manager the Guardians of New Zealand Superannuation, said the return on Treasury Bills represented the opportunity cost to the Government of contributing to the Super Fund.

“The value we create over and above the return on government debt is a very important measurement of our success, so it is satisfying to be able to report that our investment activities have outperformed the Treasury Bill benchmark by $6.44 billion during the past year and by more than $44 billion during the lifetime of the Fund to date,” said Ms Steed.

Ms Steed cited the strong recovery of global sharemarkets as a major contributor to the turnaround from the previous year’s performance.

“Our Reference Portfolio, which is made up of 80 percent shares and 20 percent fixed interest assets, returned 18.3 percent for the year, as opposed to our Actual Portfolio return of 16.03 percent,” said Ms Steed.

It’s a marked difference to 2022, when falling sharemarkets saw the Fund’s Actual Portfolio outperform the Reference Portfolio by 8.84 percent, but Ms Steed says that degree of volatility is part and parcel of the Fund’s emphasis on growth.

“Our long-term investment horizon allows us to take on a greater degree of risk than might be appropriate for a Fund with more immediate liabilities,” said Ms Steed.

“In the short term, returns will vary and sometimes quite significantly. However, what matters to us is performance over time, and over the lifetime of the Fund to date, the Guardians’ active management strategies have earned the Fund almost $16 billion more than investing in a passive, index-linked portfolio such as the Reference Portfolio would have yielded.”